Avoid Panic: How to Reduce Your Delaware Franchise Tax from $87K to $400

A founder's guide to not overpaying Delaware by tens of thousands

My heart nearly stopped when I saw the number: $87,695 due to Delaware for my startup's annual franchise tax.

If you're a Delaware C-corp founder, you might soon face this same panic-inducing moment—but I'm here to save you both money and stress.

The Critical Deadline

Delaware entities must file an annual report and pay a franchise tax by March 1, 2025. If you miss this deadline, there's a $200 late fee.

Why You're Getting a Massive Tax Bill

Delaware calculates franchise taxes in two ways:

Authorized Shares Method (default): Often leads to huge, unrealistic numbers

Assumed Par Value Capital Method: Usually dramatically cheaper

Why the big difference?

The Authorized Shares Method calculates franchise tax based on the total number of shares authorized, which often leads to an extremely high tax amount, especially for startups that authorize many shares but haven't actually raised significant capital.

The Assumed Par Value Capital Method calculates franchise tax based on total gross assets, issued shares, and their par value, typically resulting in a significantly lower tax burden for startups.

My Own Shocking Experience

As I told my business mastermind group today:

"In case anyone panics - Delaware default calculation for my entity was: $87K. I am filing this myself."

The results were dramatic:

Before: $86,695 using the default Authorized Shares Method

After: $400 (+minor fees) using the Assumed Par Value Capital Method

Time spent: Just 15 minutes to complete the filing

Additional savings: $500 in CPA fees by handling it myself

That's a 99.5% reduction by simply selecting a different calculation method!

You're Not Alone

Two founders in our H1B Founders community shared similar stories last month:

Arjun saw his bill drop from $75,000 to $450

Priya reduced hers from $92,000 to $400

The Simple Fix That Saves Thousands

Here's what you do:

✅ Switch to the Assumed Par Value Capital Method

Enter two key things:

Total Gross Assets: Total assets from your balance sheet (cash, receivables, etc.)

Issued Shares: Actual number of shares you've issued (usually far fewer than authorized)

How to Make the Switch

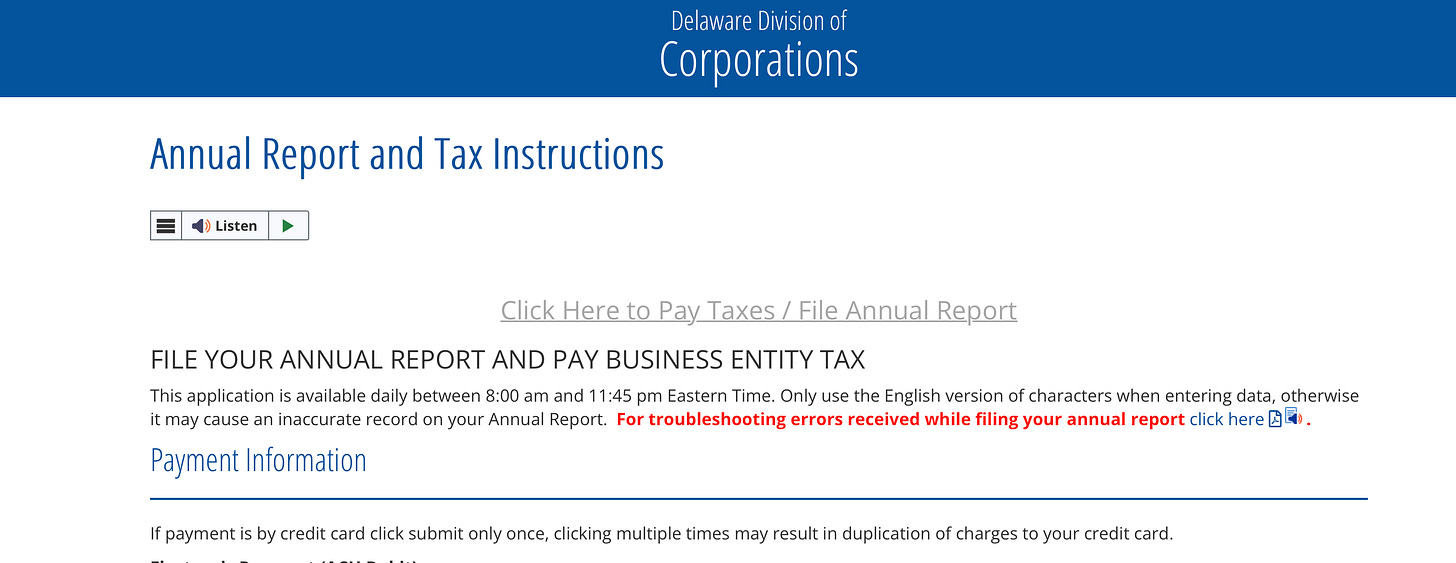

Log into Delaware's Division of Corporations website

When completing your annual report, look for "Calculate Tax" options

Select "Assumed Par Value Capital Method" instead of the default

Enter your total gross assets and issued shares

Double-check the calculation before paying

The good news is that Delaware provides a free online system for filing and paying your taxes. You don't need expensive software or services to handle this yourself.

TL;DR

Don't panic when you see a massive Delaware franchise tax bill! Switch to the Assumed Par Value Capital Method and save 99% of what Delaware initially shows you. The process takes 15 minutes and can save you tens of thousands of dollars.

Found this helpful? Forward it to another founder who might be facing the same shock. For more practical insights like this, join our H1B Founders Slack community of 800+ immigrant entrepreneurs where we share resources like this every day.

Have questions about this process? Reply to this email or drop a comment—I'll personally help you navigate this.

P.S. This is especially important for international founders forming Delaware entities remotely. Many services don't warn you about this, leading to unnecessary panic when tax notices arrive.

Hi Sid

I am trying to book a call with you but it is not letting me pay since it is showing an error. Can I pay to direct through zelle or something and then schedule a call with you.

Please let me know.

Best ,

Pahul

Great write-up! While this is not an endorsement I want to flag that I used "tryfondo.com" to file my delaware taxes. It was quick, painless and easy. It helped ease the burden of figuring out all the details on my own.

PS: at the time they had a $1 sign-up promotion. So I was able to get started with them very cheaply!