BOI Reporting 101: New Federal Requirements for All US Business Owners in 2024

A 10-minute guide to the new FinCEN requirement that affects all US companies. Deadline: Dec 31, 2024.

As immigrant entrepreneurs, staying compliant with US regulations is crucial for our businesses. There's a new federal requirement that affects all of us running companies in the US: Beneficial Ownership Information (BOI) reporting.

What is BOI Reporting?

The Corporate Transparency Act, enacted in 2021, requires most companies doing business in the United States to report information about who ultimately owns or controls them to FinCEN (Financial Crimes Enforcement Network).

Key Things You Need to Know

Who Needs to File?

All corporations and LLCs created by filing with a US state

Foreign companies registered to do business in the US

Applies to most startups and small businesses

What Information is Reported?

Details about individuals who own 25% or more of the company

Basic company information

One-time filing (not an annual requirement)

Updates needed only when information changes

Important Deadlines

Existing Companies:

If your company was created before January 1, 2024: File by January 1, 2025

New Companies:

Created in 2024: File within 90 days of registration

Created in 2025 or later: File within 30 days of registration

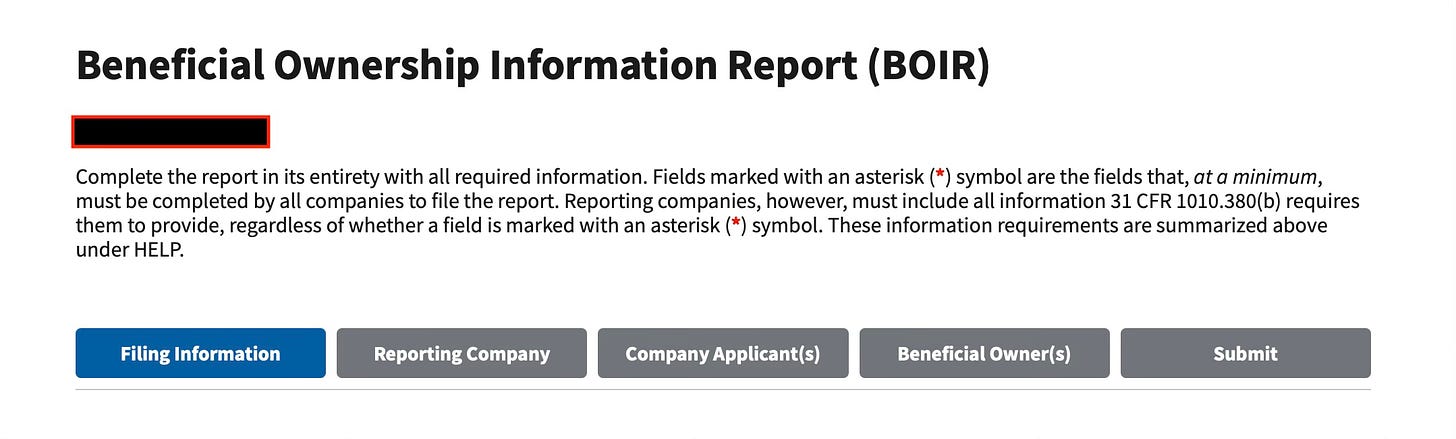

How to File

The good news? This is something you can do yourself in about 10 minutes. Here's how:

Have ready:

EIN Number (from Company formation documents)

Ownership structure information

Basic identifying information for owners (Driving License or Passport)

You can select to download, complete and submit a PDF or do it online. I recommend using the online form.

There's no filing fee

Tips from Our Community

As someone who recently went through this process, here are my recommendations:

Don't delay: While the deadline might seem far, it's better to handle this early

Keep records: Save your filing confirmation for future reference

Set reminders: If your ownership structure changes, you'll need to update within 30 days

Document everything: Maintain clear records of ownership percentages and changes

Need Help?

Email me at sid@h1bfounders.com to join our WhatsApp community of 700+ founders for real-time support

Check out our resources at h1bfounders.com

Drop your questions in the comments below - I'll personally respond

What's Next?

We're planning another detailed session with our legal experts to walk through compliance requirements for immigrant founders. Stay tuned for the announcement!